Click play to watch video that goes into detail:

Choosing the right car insurance can be confusing, especially with all the different options and jargon. This guide breaks down the key differences between PLPD and full coverage car insurance in easy-to-understand terms, helping you make an informed decision.

Understanding PLPD Coverage

PLPD, which stands for Personal Liability and Property Damage, is a type of car insurance that covers what you are legally liable for in the event of an accident. This means if you cause an accident, PLPD will pay for:

- Bodily injuries to others: This covers medical expenses for people injured in the accident who were not in your car.

- Property damage to others’ vehicles: This covers repairs to other vehicles involved in the accident that you are at fault for.

Why PLPD is Required in Michigan

Michigan is a no-fault state, which means that regardless of who caused the accident, each driver involved will turn to their own insurance company for coverage. PLPD is mandatory in Michigan to ensure that all drivers have some level of financial responsibility in case of an accident.

Full Coverage: The Extra Layer of Protection

All though, Full coverage is a made-up term, in most cases it allows the car insurance goes beyond PLPD by offering additional protection for your own vehicle. It typically includes two main types of coverage:

- Collision coverage: This covers damage to your car caused by a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive coverage: This covers damage to your car caused by events other than collisions, such as theft, vandalism, fire, hail, or animal strikes.

Full Coverage vs. PLPD: Weighing the Options

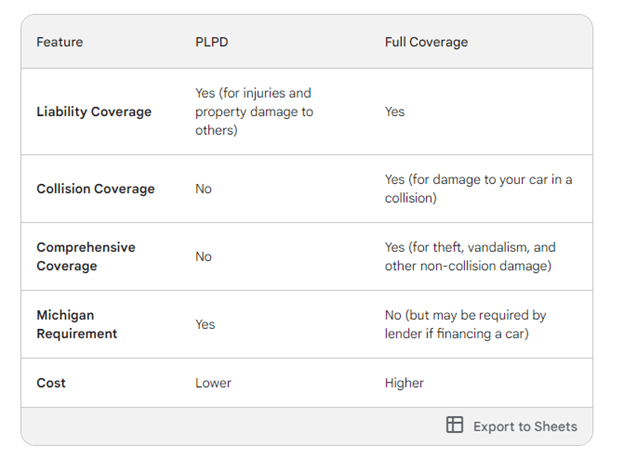

While PLPD is the minimum required insurance in Michigan, full coverage offers a more comprehensive safety net. Here’s a breakdown of the pros and cons to help you decide which option is right for you:

PLPD

- Pros: Lower cost, good option for older cars with low value.

- Cons: Doesn’t cover damage to your own car, may not be enough protection for newer cars or financed vehicles.

Full Coverage

- Pros: Provides more protection for your car, gives peace of mind for newer cars or financed vehicles.

- Cons: Higher cost than PLPD.

Additional Considerations Beyond PLPD and Full Coverage

When choosing car insurance, it’s important to consider not just the basic coverage types (PLPD and full coverage) but also other factors that can impact your overall coverage and cost:

- Deductible: This is the amount you pay out of pocket before your insurance company starts covering the cost of repairs or damages. A lower deductible means you’ll pay less out of pocket in the event of a claim, but your premiums will be higher. Conversely, a higher deductible will lower your premiums but require you to pay more upfront in case of a claim.

- Additional Coverages: There are various additional coverages you can add to your policy, such as gap insurance (which covers the difference between your car’s value and what your insurance company pays if it’s totaled) and rental car coverage. Road service coverage. Some additional coverage may only be available if you have comprehensive coverage.

The Bottom Line: Choose the Coverage That Fits Your Needs

The best car insurance for you depends on your individual circumstances. Consider your car’s value, your risk tolerance, and your budget. If you have an older car with a low value and are on a tight budget, PLPD might be sufficient. However, if you have a newer car, a financed vehicle, or want more peace of mind, full coverage is a better option.

Remember, car insurance is there to protect you financially in the event of an accident. By understanding the different coverage options and choosing the right plan for your needs, you can ensure you have the peace of mind you deserve on the road.